Energy Audits for CFOs. What the Numbers Mean

CFOs sit at the top of all costs and capital expenses - with ever more pressure to reduce rising costs. Energy audits matter because they turn site-level detail into numbers you can trust. Not promises. Not generic savings claims. Decision grade inputs.

This article explains what a commercial energy audit provides as a CFO, how to interpret the numbers, and how to use them within budget cycles, capital planning, and governance processes.

Why CFOs get pulled into energy audits

Energy costs are no longer background noise.

For many commercial and industrial sites in Australia:

Energy is a top-five operating cost

Price volatility creates budget risk

An ageing plant increases unplanned capex

Emissions reporting adds board visibility

An energy audit provides a controlled way to address these pressures. It replaces assumptions with evidence from your actual site.

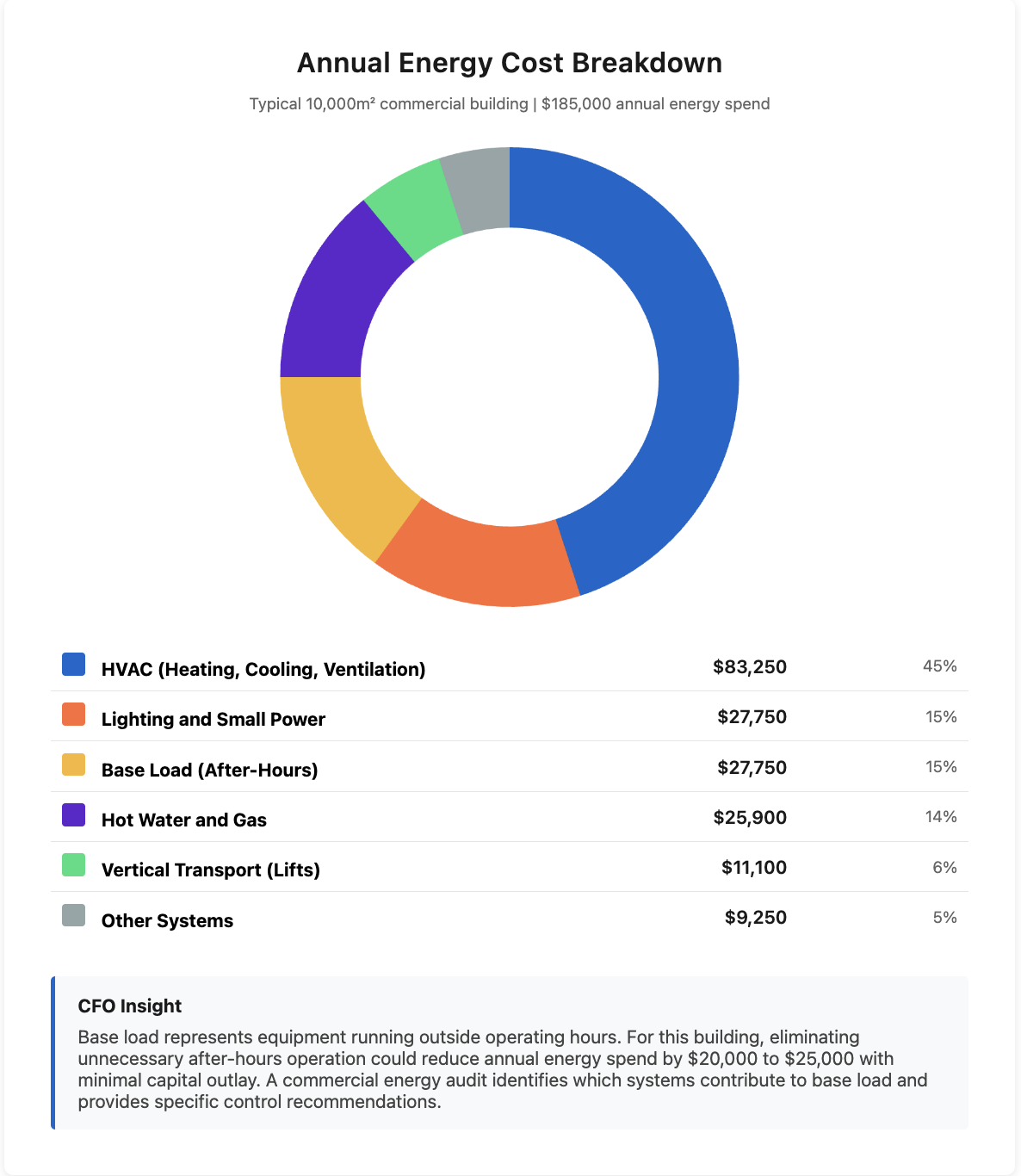

What an energy audit measures in financial terms

An energy audit does not start with savings targets. It starts with measured reality.

At a minimum, a commercial energy audit quantifies:

Annual energy spent on fuel and tariff

Load profiles showing when energy is used

Base load that persists outside operating hours

System-level contributors such as HVAC, refrigeration, process loads, compressed air, and lighting

For a CFO, this matters because it answers one core question.

Where is money actually being spent, and why?

This is different from invoices or high-level energy reports. Audits link cost to physical systems and operating behaviour.

How to read audit savings numbers properly

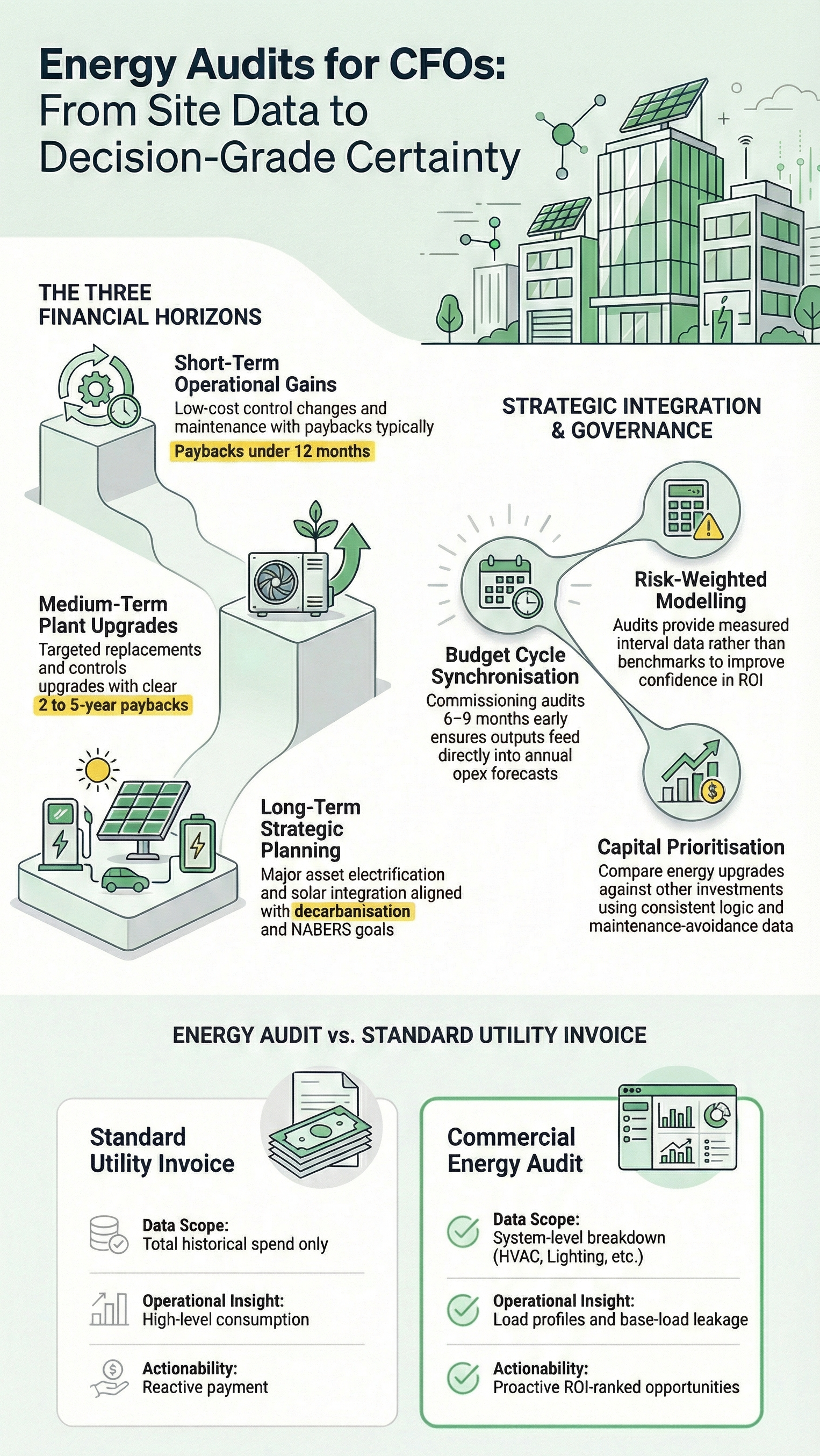

Energy audit reports usually present opportunities across short, medium, and longer horizons.

Short-term actions

These are low or no-capital items.

Scheduling and control changes

Setpoint corrections

Eliminating after-hours operation

Maintenance and recommissioning

Indicative financial characteristics:

Low implementation cost

Paybacks are often under 12 months

High confidence

These are usually the first actions CFOs support because they reduce opex quickly with minimal risk.

Medium-term upgrades

These involve modest capital.

Controls upgrades

Variable speed drives

Targeted plant replacements

Heat recovery

Indicative financial characteristics:

Paybacks in the 2 to 5 year range

Moderate capex

Clear opex reduction

Longer-term capital decisions

These support major asset or decarbonisation planning.

Full plant replacement

Electrification of gas systems

Solar and storage integration

Indicative financial characteristics:

Higher capex

Longer paybacks

Strong linkage to asset life, emissions strategy, and NABERS improvement

A good audit separates these clearly so you can decide what fits your capital cycle

What confidence looks like in an audit

Not all savings numbers carry the same weight.

For CFOs, confidence comes from:

Measured interval data, not benchmarks

Clear assumptions stated in plain language

Site constraints acknowledged

Implementation effort considered

In practical terms, this means an audit should tell you:

What is certain

What depends on behaviour or controls

What relies on future capital approval

This allows you to apply appropriate risk weighting in financial models.

How audits support capex decisions

Energy audits are not business cases. They are inputs to them.

Used properly, audit outputs support:

Capex prioritisation across competing projects

Timing decisions aligned to the asset's end of life

Comparison between energy upgrades and other investments

For example, an audit may show that an HVAC upgrade:

Reduces energy spend by a defined amount

Avoids maintenance escalation on ageing plant

Improves NABERS trajectory

That allows finance to compare it against other capital uses using consistent logic.

This is where energy audits support capital governance rather than bypass it.

Energy audits and budget cycles

One reason audits stall is timing.

From a finance perspective, audits work best when they align with:

Annual budgeting

Mid-cycle reforecasting

Major asset planning windows

An audit completed too late becomes shelfware. One completed ahead of budget season feeds directly into:

Opex forecasts

Capex planning

Board papers

This is why many organisations commission audits 6 to 9 months before major budget decisions.

How audits reduce financial risk

Beyond savings, audits reduce risk in less visible ways.

They help CFOs:

Identify hidden base load cost leakage

Avoid under-scoped plant replacement

Reduce reliance on vendor claims

Improve confidence in emissions reporting

For organisations reporting under NABERS or broader ESG frameworks, audits also support consistency between financial and sustainability narratives.

What CFOs should expect to receive

A commercial energy audit suitable for CFO use should include:

Clear cost baselines

Ranked opportunities with indicative costs and savings

Stated assumptions and exclusions

Implementation considerations

A pathway, not a shopping list

If the report cannot be translated into a spreadsheet or board slide, it is not doing its job.

You can see what a complete audit deliverable looks like in our guide to what you receive from a commercial energy audit.

How does this fit with other roles?

CFOs are not expected to manage energy projects.

Audits work best when:

Facility Managers validate site practicality

Operations Managers confirm operational impact

Finance assesses commercial viability

This shared view reduces friction later. It also prevents projects from being reworked after approval.

If you want to understand how audits support site teams, see our articles on energy audits for Facility Managers and energy audits for Operations Managers.

When an audit is worth doing

From a CFO's perspective, audits usually make sense when:

Annual energy spend is material to opex

Assets are ageing or unreliable

Capital decisions are approaching

Emissions performance is under scrutiny

They are decision tools. Not compliance exercises.

Next step

If you are responsible for budgets, capital approval, or board reporting, an energy audit gives you numbers you can test, challenge, and use.

If you want to understand how audits support site teams, see our articles on energy audits for Facility Managers and energy audits for Operations Managers.

Find out about available energy reduction grants and subsidies for your organisation on our Grants page